Please enter your values in the Weighted Average Cost of Capital (WACC) Calculator. Example is included below.

Total Equity (E):

Cost of Equity in % (Re):

Total Debt (D):

Cost of Debt in % (Rd):

Corporate Tax Rate in % (Tc):

How to use the Weighted Average Cost of Capital (WACC) Calculator

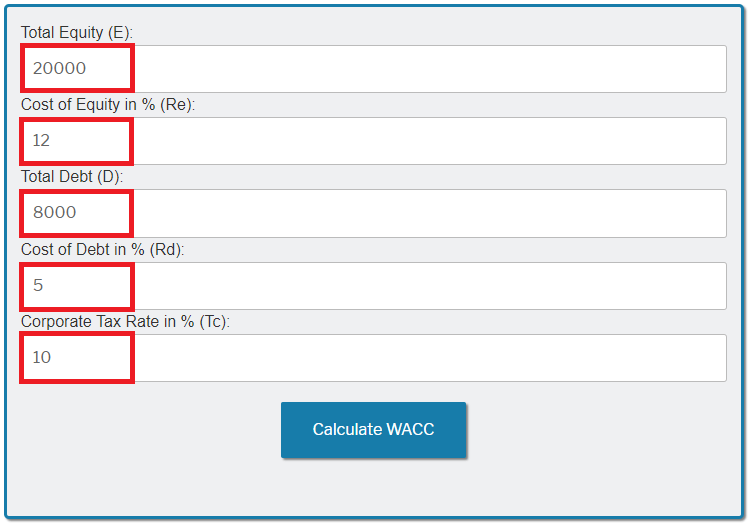

Let’s review a simple example in order to demonstrate how to use the WACC Calculator.

Suppose that you’d like to compute the WACC given the following information:

- Total Equity (E) = 20000

- Cost of Equity (Re) = 12%

- Total Debt (D) = 8000

- Cost of Debt (Rd) = 5%

- Corporate Tax Rate (Tc) = 10%

Enter the above values in the WACC calculator, and then click on the Calculate WACC button:

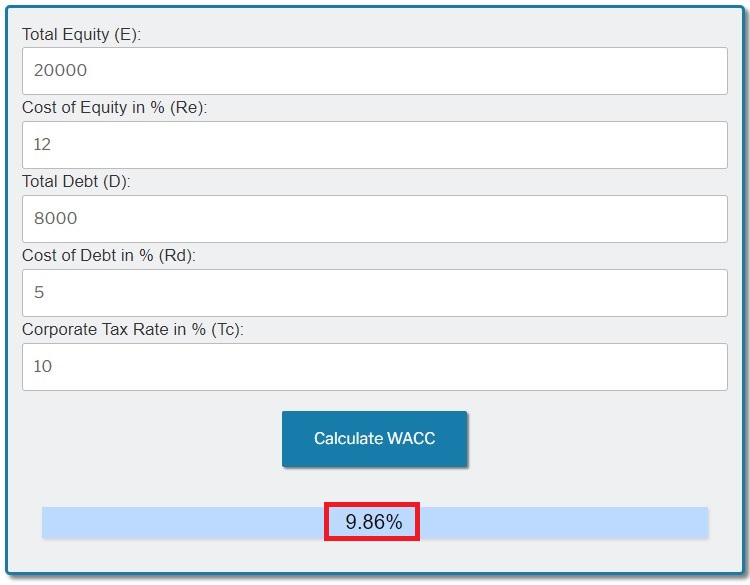

You’ll then get a WACC of 9.86%:

How to Manually Derive the WACC

You may use the following formula to manually calculate the WACC:

E x Re D x Rd x (1 - Tc) WACC = E + D + E + D

Where:

- E = Total Equity

- Re = Cost of Equity

- D = Total Debt

- Rd = Cost of Debt

- Tc = Corporate Tax Rate

For example, let’s suppose that your goal is to calculate the WACC, given the following information:

- Total Equity (E) = 20000

- Cost of Equity (Re) = 12%

- Total Debt (D) = 8000

- Cost of Debt (Rd) = 5%

- Corporate Tax Rate (Tc) = 10%

You can then enter the above values in the WACC formula:

E x Re D x Rd x (1 - Tc) 20000 x 0.12 8000 x 0.05 x (1-0.1)

WACC = E + D + E + D = 20000+8000 + 20000+8000

You’ll get a WACC of 0.0986 or 9.86%.